Tax Relief For American Families And Workers Act Of 2024 Information System – Dubbed the Tax Relief for American Families and Workers Act of 2024, this plan is the outcome of extended negotiations between Republicans and Democrats. If enacted, it would resurrect the child tax . The utmost refundable portion of the CTC is projected to increase from the current $1,600 per child to $1,800 in 2023, $1,900 in 2024, and $2,000 in 2025, according to the framework. .

Tax Relief For American Families And Workers Act Of 2024 Information System

Source : www.reuters.com

Business Roundtable

Source : www.businessroundtable.org

Pinion The Nation’s Food & Ag Consulting Accounting Firm

Source : www.pinionglobal.com

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

Pinion The Nation’s Food & Ag Consulting Accounting Firm

Source : www.pinionglobal.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

National Military Family Association

Source : www.facebook.com

DCWP Consumers Get Tips File Your Taxes

Source : www.nyc.gov

House panel advances $78 billion tax break bill in strong

Source : www.reuters.com

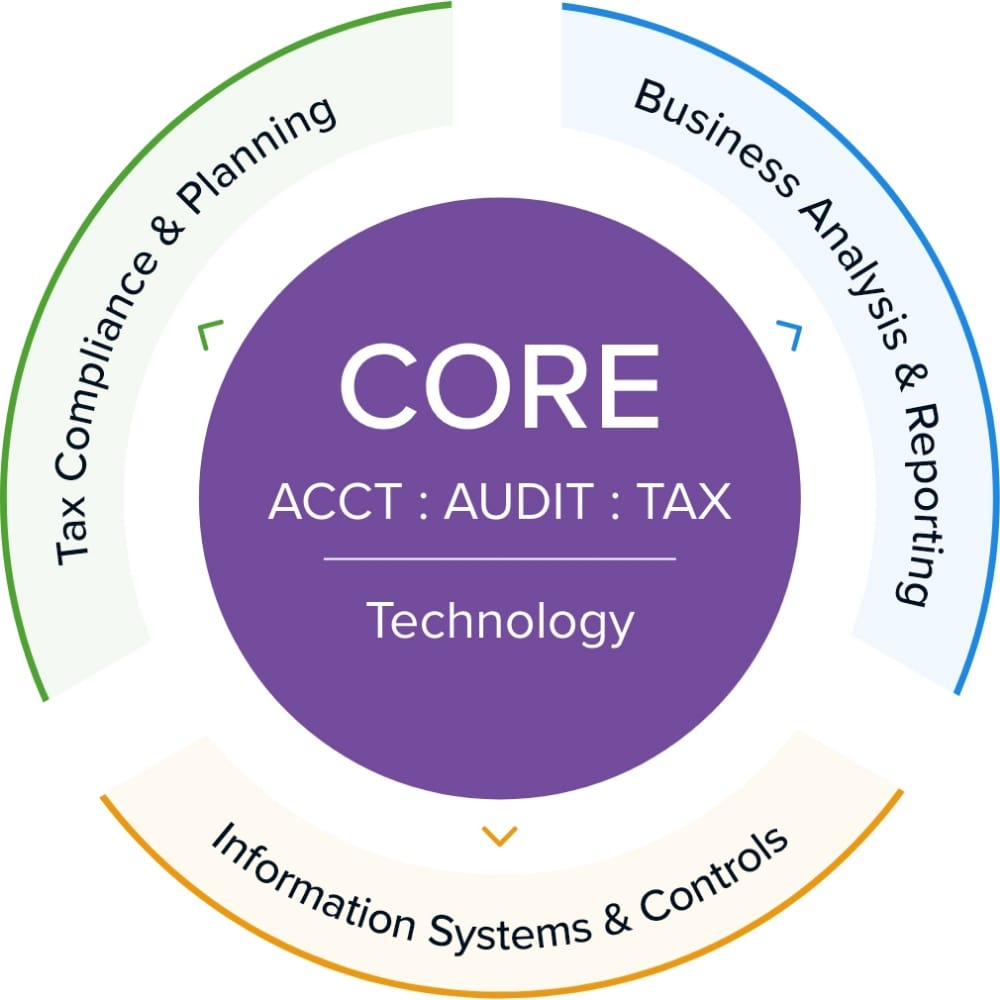

2024 CPA Exam Changes: CPA Evolution

Source : accounting.uworld.com

Tax Relief For American Families And Workers Act Of 2024 Information System House panel advances $78 billion tax break bill in strong : American households are struggling to cope with rising costs of essentials, like groceries, housing [+] and healthcare. This squeezes budgets and leaves families in 10 U.S. workers stated . California, Colorado, Idaho, Maine, Maryland, Massachusetts, Minnesota, New Jersey, New Mexico, New York, Oklahoma, Oregon, Utah, and Vermont are the states that will offer child tax credits in 2024. .

-6.jpg)